Personal Injury Finance FAQs

— Should I take out funds through settlement advance funding?

— Should I use my health insurance?

— Can my homeowner’s insurance provide medical payments coverage to me after an auto collision?

— Should I negotiate my medical bills on my own?

— How can I prevent my unpaid medical bills from being sold to debt collectors?

— What expenses can I claim as damages in a personal injury case?

Should I take out funds through settlement advance funding?

Many personal injury claims are the result of a traumatic automobile collision. Not only is your vehicle now damaged or even totaled, you might have medical bills, and you may have to take some time off of work due to your injuries or lack of transportation. There are no extensions on your rent, utility payments, and sometimes even the payments for a vehicle you can no longer drive. The same thing can happen in any other kind of personal injury case. A slip and fall can keep you from returning to work for months because your employer is worried about a worker’s compensation claim if you are injured even further. Some employers disregard your injury and just terminate you to hire someone who can work immediately without injury.

Depending on the complexity of your case, you may not see any settlement funds for six months or even two years. How are you to handle such a financial burden? Settlement Advance Funding is a tempting solution. Approval can be granted within a week or two, and you could have a sizeable check in hand. Additionally, if your case goes to trial and you do not receive a verdict in your favor, you do not have to repay your Settlement Advance. However, if your case is successful at trial or you reach a settlement with the at-fault party, you will owe in most cases twice the amount you received back. Most Settlement Advance Funding agreements have steep repayment rates that increase exponentially the longer your case goes on.

Some agreements do not even cap the compensation amount and have led to cases where you might owe over 200% or 300% of the original amount you received. That means if you received a $1,000 Settlement Advance, you could end up owing over $2,000 to $3,000 by the time your case ends. In comparison, in the United States in 2016 the average personal loan interest rate is somewhere between 10% and 12%.

Settlement Advance Funding should only be used as a last resort after all other options have been exhausted, and even then, the smallest amount possible should be requested due to the high repayment rate and rapidly-increasing repayment amount.

Should I use my health insurance?

It is very common for a medical provider, upon learning your injuries are the result of a personal injury event, to refuse to bill your health insurance provider, instead requesting you to agree to an attorney-physician lien on your personal injury settlement or verdict funds. Health Insurance companies contract with medical providers to provide services and treatment at a negotiated rate. If you have ever been without health insurance and gone to the emergency room or had an office visit, the amount you are required to pay is far higher than if you had health insurance.

When medical providers know that the funds for your treatment will not be coming directly from you, but from either a negligent defendant or a sizable insurance policy, those providers seek compensation above the small contracted amount that has been negotiated with a health insurance plan. If your medical provider refuses to bill your health insurance, this is a red flag that your medical provider is acting in their best financial interest and not in your best interest.

You should always use your health insurance and seek medical professionals within your health insurance network if applicable. Using health insurance will increase your net settlement recovery 100% of the time in a personal injury case.

Can my homeowner’s insurance provide medical payments coverage to me after an auto collision?

If you have homeowner’s or renter’s insurance, there are often special provisions for medical payments coverage similar to your automobile insurance medical payments coverage. Medical payments coverage does not determine who was at fault but only disperses funds for medical bills incurred as a result of an injury sustained on your property or while traveling in your vehicle. Each insurance contract will have specific payout provisions, but many homeowner’s and renter’s insurance medical payments policies cover personal injury events. All you have to do is submit your medical bills and/or medical records to receive immediate payment of your benefits.

Additionally, medical payments coverage is considered a return of your insurance premium payments and in most states is not considered compensation that would reduce your settlement amount.

Should I negotiate my medical bills on my own?

The only time you would need to negotiate your medical bills in a personal injury case is either if you do not have health insurance or your insurance denied you coverage for necessary medical treatment. If you have hired an attorney to pursue your personal injury claim, your attorney can negotiate on your behalf and can do so very well, especially if your attorney has worked with your medical provider in the past and has built a positive relationship. However, the majority of the time, you are better off negotiating your unpaid medical bills.

Most medical providers do not have the staff or the time to follow up on unpaid medical bills more than a few times. Most likely, you will just receive the same auto-generated bill in the mail month after month. Start by calling the billing department, if there is one, and establishing the total amount of your unpaid bill. Every so often, billing errors happen, and it is good to make sure you and your provider are on the same page about the services you received and the charges for those services. Some medical providers will accept payment in full for a lesser amount if you can pay within 30 days. For those who do not have health insurance, or for those whose health insurance has declined coverage, total bill reductions range from 20%-60% depending on the medical provider. Offering to pay 40% of your total amount owed is a good place to start and the billing department, or your medical provider may agree or counter with a different number. If negotiating a lump sum reduced amount does not work, providers often allow the entire balance to be paid on a monthly basis. These monthly payments are usually agreed to verbally over the phone, and a note is made in your file.

Most medical providers are sympathetic and will work with you if you are sincerely trying to pay your bill but are suffering financial hardship, especially if you were injured as a result of someone else’s negligence.

How can I prevent my unpaid medical bills from being sold to debt collectors?

The most common problem for someone with a personal injury claim is unpaid medical bills or unpaid health insurance co-payments or unpaid co-insurance amounts. After a period ranging from 30 to 90 days, most unpaid amounts owed to medical providers or health insurance providers will be sold for pennies on the dollar to a debt collection agency. Debt collection agencies will harass you via phone calls, emails, and countless letters tacking on late fees and extra collection charges.

The best way to avoid having your unpaid bills sent to a debt collection agency is to set up a payment plan with your medical provider or your health insurance provider. If you absolutely cannot make any payments as a result of a personal injury event, you will have little to no recourse unless you have hired a personal injury attorney. Many states have statutes created by the state legislature to protect those injured physically and financially as a result of another’s negligence. A personal injury attorney can send a cease and desist letter to your medical provider or your health insurance provider to freeze your unpaid debts and prevent them from being sold to a debt collection agency. Financial insolvency caused by the negligence of another can create a remedy under the law for you to take advantage of if your medical provider or health insurance provider sells your debt and reports you to any of the major credit rating agencies. Remember, if your debt is sold for non-payment, this also is reported to one or more major credit rating agencies and your credit rating could drop as a result.

The best way to avoid having your unpaid medical bills sold is to have a personal injury attorney on your side and to be frank and honest with your attorney about your unpaid medical bills. A personal injury attorney will not judge you for your financial difficulties and will have many options available to protect your credit and to prevent harassment from unscrupulous debt collection agencies.

What expenses can I claim as damages in a personal injury case?

Most personal injury attorneys will tell you that almost everything can be considered damages in a personal injury case, so long as you would not have incurred that expense without the personal injury. However, who incurs the expense is also critical, even if you as the injured party are the person benefiting from the expense.

For example, if a friend drives your car with you in it to a doctor’s appointment, you may be entitled to reasonable mileage expenses since it is your car and theoretically filled with gas you paid for. However, if your friend drives you in his car with his gas, your friend is not entitled to recover any mileage expenses nor are you allowed to recover on his behalf any mileage expenses. It is very common for family and close friends to assist with expenses, childcare, and in other ways. Often, those close to us may expect compensation if they know you have hired an attorney and a settlement will be coming your way in the future. It is important to explain to your family about what your attorney can recover for you and that they may not make a claim for expenses even though they may spend valuable time and money to assist you during your recovery.

Another limitation on damages is what is “reasonable and necessary.” For instance, if your physician allows you to return to work after two weeks, but you still feel unwell and stay home an additional two weeks, you may not be able to recover lost wages for the additional two weeks since your physician deemed you physically able to return to your job after only two weeks.

Using the same transportation example from above, we can conclude that it may be reasonable to take an Uber or a short cab ride to a doctor’s visit and have that expense covered. However, if you use a luxury rental service or choose to see a general physician several hours away when you have other equally capable doctors nearby, you may only receive compensation that is reasonable and not the full value of your travel expenses.

Listed below are many common expenses that can be claimed as damages in your personal injury case, but even these expenses will also be subjected to the “reasonable and necessary” test:

- medical bills

- transportation mileage to and from your medical visits

- medication costs

- medical supplies (i.e. slings, crutches, braces, wound care supplies, etc.)

- lost wages and/or lost business opportunities

- personal property value (i.e. phone or prescription glasses damaged during event of injury)

When in doubt, consult with your attorney as to whether an expense can be claimed as damages in your personal injury case, and about any other questions relating to personal injury finance.

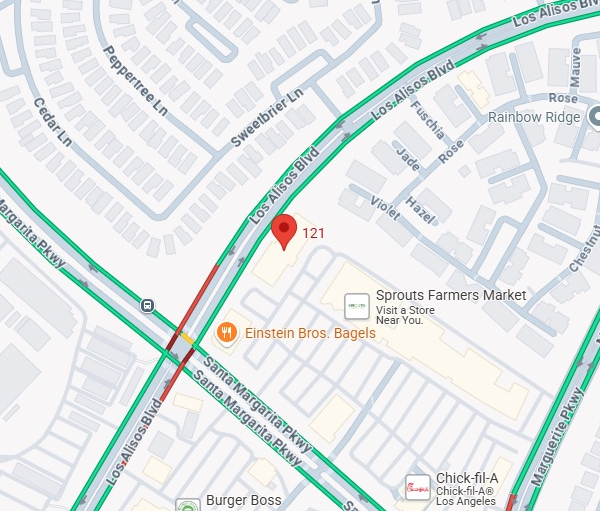

Locations

Phone: (951) 485-4000

Toll-Free: (800) 268-9228

Grandville Executive Suites

7121 Magnolia Ave., #V3

Riverside, CA 92504